Whether you are travelling to France for leisure or importing/exporting from/to France, you can have some formalities to handle beforehand. This page identifies all our content available in English and will guide you through your formalities.

Travellers or businesses, the French Customs provide information in English and other languages

Dossiers

Publications (PDF)

Factsheets

- Volume- and value-based customs and tax allowances

- Citizens and travellers, get prepared to Brexit!

- Brexit: Individuals and travellers, frequently asked questions

- The obligation to declare cash, securities and valuables

- Transferring your primary residence to France

- Travel: coming to France with your pet

- You are moving to a French overseas département

- You have come to France to study

- Eligibility for VAT refunds

- Private individuals carrying medicinal products in France

- Regional customs information centers in France

- Conference Brexit: one year of customs formalities, assessment and perspectives

Vidéos

You bought item(s) in France, eligible for a tax refund.

What changes for travelers who are coming from or going to the United Kingdom.

Dossiers

- French Customs for business

- Working through Brexit together

- Understanding and preparing for the import-export overhaul

Publications (PDF)

- Customs clearance in France - 40 concrete measures to support businesses

- 10 Questions to ask before exporting

- 10 Questions to ask before importing

- Counterfeit - Application for action with French Customs

- International training by French Customs

- French Customs - 2019 results

- French Customs - 2018 results

- French Customs - 2017 results

- Customs clearance in France - The new Union customs code

- Brexit - How to make a successful import thanks to the smart border

- Brexit - How to make a successful export thanks to the smart border

- Brexit-Drivers : what TO SCAN and NOT TO SCAN to enter OR leave France

- Preparing for Brexit - French customs guidelines

- French Customs is changing - Strategy 2022-2025 of the General Directorate of Customs and Excise

Factsheets

- Businesses, check your EORI number

- Businesses, get prepared to Brexit

- Brexit: Economic operators, frequently asked questions

- Formalities for intra-Community trade

- Alcohol and alcoholic beverages – Definition and tax regime

- Taxation and excise duties

- Movement of energy products

- Obtaining authorised warehouse-keeper status

- Taxation of alcoholic beverages: intermediate products

- Introduction to taxes on oil products

- Changes to the partial refund of the domestic tax on consumption of energy products (TICPE) for European goods hauliers and passenger transport companies

- Large Accounts Department (SGC)

- Postponed accounting for import VAT

- Regional customs information centers in France

- Economic Operator Registration and Identification (EORI) number

- TGAP (General Tax on Polluting Activities)

- Contact a customs attaché in your country

- International training capacities of French Customs

- The electronic administrative document (e-AD)

- What you need to know about export procedures

- Methods for collecting import VAT

- Distance sales of alcoholic beverages from EU to France

- Incoterms and customs value

- Registered Customs Representatives

- Mineral oils – Bonds and guarantees

- Information for businesses operating across the French and English border

Vidéos

Presentation and Discussion of the New Plan “Customs Clearance in France”.

Dossier

Publications (PDF)

- Brexit guide for travellers

- Preparing for Brexit - French customs guidelines

- BREXIT: Trade and cooperation agreement between the EU and the UK

- Import or export post Brexit

- A smart border for smart drivers

- Drivers : what TO SCAN and NOT TO SCAN to enter OR leave France

- Functional specifications for shipping companies and ports

- Import Control System (ICS) - Mandatory safety & security formalities (ENS) for the introduction of goods into the EU

- The Smart Border - Presentation

- The Smart Border - Case studies

- Brexit - How to make a successful import thanks to the smart border

- Brexit - How to make a successful export thanks to the smart border

- Goods subject to sanitary and phytosanitary controls (SPS) - How to successfully import with the smart border?

Factsheets

- Brexit: A trade and cooperation agreement was reached with the United Kingdom

- Citizens and travellers, get prepared to Brexit!

- Businesses, get prepared to Brexit

- Brexit: The smart border

- Brexit: Economic operators, frequently asked questions

- Brexit: Individuals and travellers, frequently asked questions

- Information for businesses operating across the French and English border

Vidéos

What changes for travelers who are coming from or going to the United Kingdom.

In the frame of the re-establishment of the border between the UK and France.

This procedure aims to secure the flow of international trade when entering the territory of the UE.

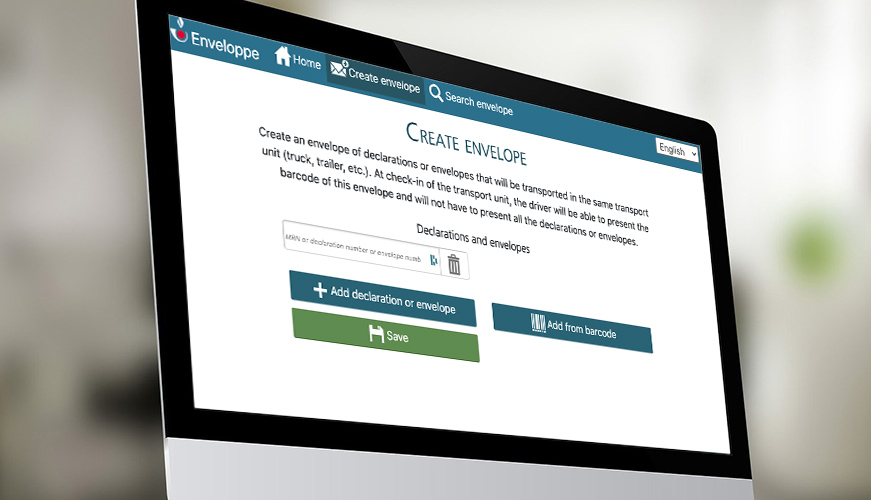

What to scan:

- Import to declaration, logistics envelope, common transit accompanying document, EU transit accompanying document.

What not to scan:

- UK export declaration, safety and security document.

After ten months of intense negotiations, an agreement between the United Kingdom and the European Union was concluded on December 24, 2020 and will enter into force provisionally on January 1, 2021.

In the frame of the re-establishment of the border between the UK and France.

By Caroline de Saussure, project leader Brexit.

French customs webinar: EU exports to UK exited via France